A Bank of Canada Tutorial

While this refers to Canada it is a must read for all, as it also includes France, Germany, Italy, Japan, Russia, the UK and the US. In fact the sphere of influence extends to nearly all the world. Those countries, such as the ones on the gold standard and others that are not under the current world bank scam regimen are in great danger of having their monetary methods usurped. This through the typical installation of puppet governments that will conform to such control tactics. All in the name of democracy of course!

This is the primary reason why we have taxes.... to be further crystallized in an another post on the US Federal Reserve system coming soon.

Chris Gupta

--------------------

A Bank of Canada Tutorial (Original is here)

Welcome to CAP'S Bank of Canada Tutorial.

One of the major problems facing Canadian policy makers and activists today is a misunderstanding of or refusal to consider the uses of The Bank of Canada (BoC). This problem is exacerbated by a media blackout on information about the Bank's uses- which will be discussed in the tutorial.

This problem exists in all G-8 countries!

The tutorial details the nature of the problem in Canada, and how it may be resolved.

The Formation of The Bank of Canada

Until the BoC opened in 1935, The Treasury Board, which administered the Finance Act of 1923, had no responsibility to see that advances made to the banks answered the needs of the economy. The unsatisfactory nature of that arrangement was revealed during the Great Depression. In 1934 Parliament passed the Bank of Canada Act, and the bank itself was founded a year later. Since 1938 the bank has been owned entirely by a single shareholder- the federal government (i.e., Canadian taxpayers).

The Use of The Bank of Canada, 1938 - 1974

The 'nationalization' of 1938 perfected the mechanism that allows the central bank to create money to finance federal projects on a near interest-free basis. It may make loans to the Govt. of Canada or any province (BoC Act Article 18 (c), (i) (j) or guaranteed by Canada or any province (c). This is explained fully in our "Article 18" link here.

Initially, the bank fullfilled its mandate. It was of great assistance in getting Canada out of the Great Depression, financing the war, and building infrastructure and social systems in Canada into the 1970s. But then things began to change.

Global Changes in Monetary Policy

In the 70s the monetary policy of Monetarism was adopted; further, central banks worldwide began attempting to control inflation by reigning in the money supply without regard for the inevitable effects on interest rates.(Monetarists hold that the money supply alone determines price- and just about everything else!)

In mid-1991 a bill was slipped through parliament without debate or press release phasing out the statutory reserves over a two-year period (subsection 457 of Chapter 46 of the Statutes of Canada.) That left higher interest rates the only means of "fighting inflation."

Interest rates, however happen to be the revenue of money-lenders as the sole way of fighting price rise which conventional economists identify with "inflation". At the same time a campaign was launched to enshrine:

(1) the independence of the central bank from the government- though the BoC Act sets forth that all shares are owned by the federal government; that in the event of a disagreement on broad policy between the governor of the BoC and the Minister of Finance, the latter shall have the right, after thirty days written notice to conform, to dismiss the Governor. If that does not add up to the good old capitalistic definition of ownership, what does?;

(2) "zero inflation": a perfectly flat price level was proclaimed essential. Most of Canada's federal debt was run up in the attempt to enforce these provisions, which contradicted the BoC's charter. Such contradictions, however, did not deter Mr. Crow, and subsequent BoC Governors, from pursuing like policies to this day!

Two Unbelievable Facts!We now consider two unbelievable facts- so astonishing that most people simply won't believe them!! Indeed, they do defy the imagination!

Unbelievable Fact # 1: How Money is Created.

Money is created out of nothing.

Myth: it's based on Gold: Not so! The Gold Standard was abandoned years ago.

-Well....it's not quite created 'out of nothing': it's created out of a faith based on the credit of a nation: otherwise, it would be worthless. If I give you a $20 bill, you believe (have faith) that you can use it as a medium of exchange to buy other goods or services. Moreover, there are two ways to create money (out of essentially nothing).

GCM (Government Created Money), created by the federal government. People understand this method. Most people when asked would say, "well, the government creates money." That's true. But how MUCH of the money supply each year does the government create? About 5%. That's all. So who creates the rest?

BCM (Bank Created Money): the private banking system. How does the private banking system "create" money? Simple! But unbelievable! Bear in mind that MONEY IS CREATED OUT OF NOTHING. So, when you make that $30,000 loan at your bank for a new truck, that amount is typed into you bankbook. Seconds earlier it didn't exist! Now YOU owe that money TO the bank, + interest!

Myth: the money for your loan is somehow "backed" by deposits on-hand in the bank where the loan is made... Not so!

You, as a citizen or a business, don't have a choice. Much though you might like to, you can't create money. You have to borrow your money from private banks or other lending institutions.

Unbelievable Fact # 2: The Government's Choice

But governments have a choice! The federal government can EITHER create its own debt-free and interest-free money (GCM) OR borrow it AS debt, and AT interest from the private banks (BCM). The provincial and municipal governments can choose to borrow, at low interest rates, from EITHER the Bank of Canada OR borrow from the private banking system at substantial interest rates.

GUESS WHICH CHOICE OUR GOVERNMENTS MAKE??

YOU GUESSED IT! Some 95% of our money is created as BCM

-UNBELIEVABLE!!

You may say, "-So what? Some abstract argument about 'how money is created' doesn't effect me, anyway..."

-Oh yes it does! You'd better... believe it!

l It is important to realize that this is not some abstract, intellectual exercise. It's YOUR money!

l You are being flim-flammed!! Year after year after year....

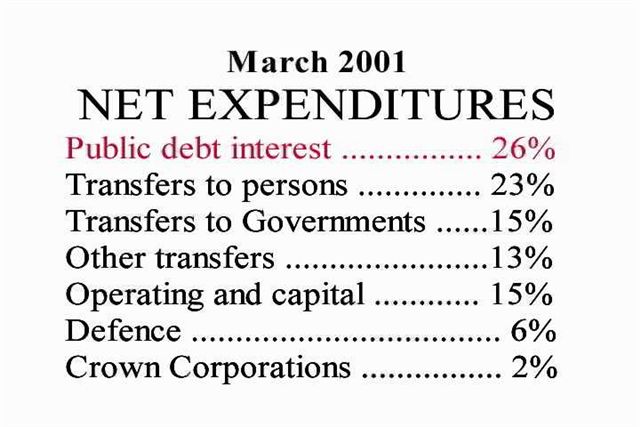

l Your LARGEST expenditure- (The so-called 'public debt interest', i.e., "paying down the debt") is to the private banking system!!

But it doesn't have to be that way!l Your (our, Canada's) money could be going towards social programs, health care, education, and so on (through Transfers, Operating and Capital Expenses, etc.) IF a larger portion of GCM existed...

Article 18The Law is the Law! In this section, we refer to Article 18 of The BoC Act, listed under BUSINESS AND POWERS OF THE BANK. Our commentary is added in red; emphasis by underline.

We mentioned earlier that since 1938 the BoC has been owned entirely by the federal government. It is essential to understand what this means, in order to understand the full significance of the powers of the BoC.

In a word, the BoC may create the money to finance federal projects on a near interest-free basis. It may, if it wishes, lend money to the provinces and municipalities as well.

It works this way: the coupons paid on government debt held by the Bank of Canada find their way back to the federal treasury with the rest of the bank's earnings. In recent years this important function of the bank has been left, in large part, to rust.

Article 18 sets out the Bank's powers of lending to our governments.

Article 18 (c), dealing with funded debt- bonds or treasury bills- authorizes the Bank to "buy and sell securities issued or guaranteed by Canada or any province."

No restriction is set on such holdings; limits on these powers must then be sought in the real economy- whether or not further money supply created by such loans would add to the demand in an economy already employing all available resources. Were the Bank to go on increasing its lending to governments under such circumstances, it would indeed be inflationary. But such a state of affairs has not existed for decades.

(i) make loans or advances for periods not exceeding six months to the Government of Canada or the government of any province on the pledge or hypothecation of readily marketable securities issued or guaranteed by Canada or any province;

(j) make loans to the Government of Canada or the government of any province, but such loans outstanding at any one time shall not, in the case of the Government of Canada, exceed one-third of the estimated revenue of the Government of Canada for its fiscal year, and shall not, in the case of a provincial government, exceed one-fourth of that government's estimated revenue for its fiscal year, and such loans shall be repaid before the end of the first quarter after the end of the fiscal year of the government that has contracted the loan...

Article 18 (j) deals with unfunded loans to governments- ie, advances against their income not formalized in security issues.

The passage "but such loans outstanding at any one time shall not..." clearly implies that such unfunded debt may be rolled over when due.

Health Care 5

Education 2

Affordable Housing 2

Kyoto Fund 1

Municipal Infrastructure 2

Armed Forces 3

Total ($billion/year) 15

Let us stretch our horizons a bit before concluding.

Just suppose the money-creation function were split equally between the government of Canada (GCM), on behalf of the citizens of Canada; and the private banking system (BCM). This would release $15 billion/year (approx.) to be used for the needs of Canadians.

-More good news! This would:

l Reduce unemployment

l Increase the GDP

l Increase tax revenues for all governments, so making funds available for other projects.

It would create a win-win situation! The people of Canada would benefit immensely, and on an ongoing basis; and the private banking system would still be making considerable profits.

Would it 'cause inflation'? Absolutely not! It is the total amount of money which determines prices, not who creates it.

~ Conclusion ~None of what we have been saying is all that hard to understand; nor is our 'Vision' impossible, untenable, or out of reach. But ideological persuasion is strong, especially when supported with the full force of media. Even many activists and investigative journalists appear to be unaware of the importance of uses of national Central Banks.

On the basis of the information given in this tutorial, you can see that what is desperately needed in Canada (and in all G-8 countries!) is for the federal Finance Minister to direct the Governor of the central bank (in Canada's case: The BoC) to create a larger percentage of what constitutes the money supply each year.

If this were done, we would have a national (and global) social structure quite different from the one we have today! The tragedy is that this could be done- today- given the political will to do so. The hope is that, someday, it will be done.

We hope that YOU will do what you can to make it come to be, through educating others about the powers and capacities of national central banks.

If you have any questions or comments about our tutorial, please contact us.

posted by Chris Gupta on Thursday July 20 2006

URL of this article:

http://www.newmediaexplorer.org/chris/2006/07/20/a_bank_of_canada_tutorial.htm

Related ArticlesArtificial Water Fluoridation: Off To A Poor Start / Fluoride Injures The Newborn

Please watch this short 5 minute video: Little Things Matter: The Impact of Toxins on the Developing Brain Toxins such as Arsenic, Lead, Mercury, Aluminum and other known and unknown chemicals, that are often above the legal limits, are deliberately added to our water to manage the disposal of toxic industrial waste chemicals under the pretense of "safe and effective" for water fluoridation mantra.Knowing and acting on the above should... [read more]

December 30, 2014 - Chris GuptaDrinking Water Fluoridation is Genotoxic & Teratogenic

This paper by Prof. Joe Cummins is a very important 5 minute delegation made to London Ontario Canada "Civic Works Committee" public participation meeting on January 25, 2012 on fluoride*. While a bit technical it is short and easy to grasp. A must read as it goes to the heart of the matter regarding the well established toxicity of fluoride which is well in all scientific circles even before water... [read more]

February 06, 2012 - Chris GuptaDemocracy At Work? - PPM On Fluoride

Here is a commentary on the recent (Jan, 25th, 2011) Public Participation Meeting (PPM) on Fluoride in the City of London, Ontario. The meeting started with a strong pro fluoride stance form the City engineer. His lack of knowledge on chemistry of the toxic wastes used to fluoridate water could embarrass even a high school student never mind his own profession. He blatantly violated his "duty to public welfare" as... [read more]

January 29, 2012 - Chris Gupta